SMR Collaboration by Conventional Legends: Siemens Energy, Rolls-Royce Partnering on Future Small Nuclear Projects

The momentum of future small modular reactor (SMR) nuclear projects is pushing the movement of new startups working hard to gain energy into the nascent market, but two legacy and legendary power generation companies are partnering to stake their own share in the next-gen technology.

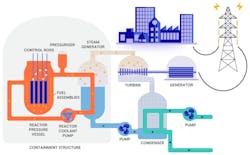

Rolls-Royce SMR is contracting with Siemens Energy for supply of conventional technology serving small nuclear projects projected over the next decade. Siemens Energy will be the sole supplier of steam turbines, generators and other auxiliary systems for UK-based Rolls-Royce SMR’s Generation 3+ modular nuclear power plants.

Interest and investment in SMRs are peaking as both large-scale customers and power generators plot their progress on paths toward both grid resource adequacy and sustainability objectives. No SMR has been commercially built or commissioned in the U.S., but companies from Microsoft to Oracle to Amazon are seeing ways to power a fleet of coming data centers in the age of artificial intelligence and hyperscale cloud-based capacity.

How British engine maker turned to reactors

Rolls-Royce is a longtime developer of engine and power technology for automobiles and aviation dating back to the early 20th century, which has included nuclear power generation since the 1950s. The company set up its SMR group in the past decade to develop a “mini nuclear power plant” which is being designed to reach operations faster than traditionally built and utility-scale nuclear plants. The Generation 3+ technology will feature pressurized water reactors capable of up to 470 MW in carbon-free output.

Siemens supplies the “power island” or non-nuclear components of the reactor facilities.

"We are currently experiencing a global renaissance of nuclear energy. Numerous countries are turning to nuclear technology to produce low-emission electricity, and small modular reactors will play a key role in this,” Karim Amin, member of the Siemens Energy Executive Board, said in a statement. “Siemens Energy brings decades of experience in conventional equipment, while Rolls-Royce has the necessary implementation expertise. This perfect symbiosis enables us to jointly shape the future of energy supply. We are very pleased to be working with Rolls-Royce SMR on this exciting project."

The hows and whys of SMR nuclear

A Siemens Energy fact sheet on SMR nuclear notes that micro or small reactors operate much like conventional plants—harnessing uranium to create a nuclear fission reaction which generates heat that converts water into usable steam for turbines--but on a smaller scale compared to the 1-GW+ units such as Vogtle 3 and 4 in Georgia.

Rolls-Royce SMR's reactor is design to work with enriched uranium no greater than 4.95% Uranium-235.

A projected SMR plant also might only take up 0.01 square kilometers in land, compared to the 1 to 2 square-kilometer footprint of a conventional nuclear power plant such as Susquehanna in Pennsylvania.

Detractors and opponents of nuclear energy and SMRs argue that the projects are too expensive to compete with renewable and gas-fired resources on the electricity markets, as well as inspire opposition by those who might live near projected SMR sites. Some industry leaders, however, say that ample and baseload nuclear will solve questions of power capacity and environmental emissions, while it also could be productive for data centers, remote industrial plants and even oil and gas operations.

The first operational SMR is anticipated to be completed in Europe by the early 2030s, maybe by the mid-2030s for the U.S. since no facilities are currently under construction. Russia and China have built and are operating commissioned SMRs.

In North America, startups such as Oklo, NuScale, X-energy, TerraPower, Kairos and Natura Resources are working toward SMR design approval and commercial development. Legacy industry leaders working on SMR include Rolls-Royce, GE Hitachi Nuclear, Westinghouse and BWXT, a spinoff of power plant engineering and construction firm Babcock & Wilcox.

Conventional nuclear currently accounts for about 18% of the U.S. utility-scale electricity generation resource mix, according to federal statistics. The nation’s 94 operating reactor units also generate more than half of all carbon-free power into the U.S. utility-scale portfolio.