There’s no shortage of news headlines about how surging data center and AI demand for electricity is straining electric grids.

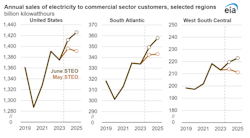

The U.S. Energy Information Administration addressed the trend this summer, raising its forecast for electricity sales to commercial customers through 2025, especially “in areas of the country with rapid data center development.”

It didn’t rule out raising its forecast again: “Data center developments are evolving rapidly, and we plan to re-evaluate our upcoming forecasts as we receive more information.”

Source: EIA

What does surging electric demand mean for the tech industry?

AI. Cloud computing. Digitization. Several trends are driving rapid tech industry growth. Much of this growth relies on the expansion of data centers across the country.

Electric utilities and grid operators around the country have sounded alarms that they’re struggling to keep up with the tech industry’s demand for more power. Already, data center operators are in fierce competition for scarce locations to interconnect new facilities to the grid.

In a recent survey conducted by Endeavor Business Intelligence on behalf of NextEra Energy Resources, more than 200 leaders from a wide range of tech companies identified areas in the U.S. where their companies are struggling to get the energy they need. More than a quarter of them named the South Atlantic states, while 23% said they struggled for energy in the central Southeastern states, 21% named California, 21% named the Mid-Atlantic, and 20% named Texas. NextEra Energy operates in 49 states, with generation projects in multiple stages of development and energy services to help tech companies find renewable energy solutions when and where they need it.

As grids work to keep up with the electricity needed to meet growing data center demand, there could be several consequences for tech companies, including curtailing their growth plans. To overcome energy limitations, they are working with utilities and grid operators to find solutions, which to this point has included extending operation of some fossil-fuel powered plants. That outcome increases scope 2 carbon emissions for tech companies, which works against their emissions-reduction plans and delays the U.S. clean energy transition.

Showcasing the demand for electricity, 84% of tech leaders surveyed agreed their organization would be willing to pay a premium to secure energy for a new facility more quickly. Meanwhile, 82% agreed their organization would choose a greenfield development location based on the availability of electric grid capacity.

What tech companies are doing to keep emissions-reduction goals moving forward

Tech companies have gained significant real-world experience overcoming hurdles to reduce emissions while growing the business.

Nearly nine in 10 tech leaders surveyed said their company has a corporate goal to reduce carbon emissions, and 72% said their companies were in the mid or advanced stages of implementing those plans. More than half said their company already gets at least 51% of its energy from zero-carbon energy sources.

Most tech leaders surveyed said their company is already using the most conventional forms of electricity: 67% use standard energy supply contracts. About half said they use on-site conventional generators, such as natural gas cogeneration or diesel generators, and 48% use a “clean energy” grid power option from the utility in which carbon emissions are offset by renewable energy credits.

For the future, tech leaders identified several renewable energy options they are pursuing. Four in 10 said their company is pursuing off-site renewable energy, such as wind and solar, to power their operations. That is followed closely by 38% pursuing on-site renewable generation, and 36% pursuing on-site battery energy storage.

When pursuing new clean energy supplies, contracts for zero-carbon electricity ranked as the best bet to be economically attractive. Ranking second was developing on-site renewable distributed energy resources (DERs), such as solar and battery energy storage systems. Survey respondents said developing on-site DERs was usually economic more often than developing efficient on-site fossil-based generation — 47% to 42%.

Generation resources aren’t the only means tech companies are working to meet their massive electricity demand while reducing emissions. Nearly 70% say they are using software and analytics to optimize energy use, while 61% are using energy and energy efficiency consultants, 53% are using equipment management and software solutions, and 48% are pursuing traditional energy efficiency measures. Tech companies have discovered that firms with energy data and analytics expertise, such as NextEra Energy Resources’ innovative NextEra 360 software, can help them improve operational efficiency, reduce costs, and unlock savings.

Tech’s challenge to balance emissions-reduction and business goals

The rate at which grid operators are delaying fossil-fueled power plant retirements demonstrates the friction between the grid’s need to deliver more electricity reliably while transitioning to more clean energy. This tension has significant implications for the tech industry’s ambitious emissions reduction and business growth goals. However, the tactics tech leaders report their companies are pursuing to procure clean energy supplies and use energy more efficiently prove they’re finding ways to make progress toward both.

Finding the right path forward to maximize growth and meet emissions-reduction goals is a complex task. Collaborating with clean energy experts is often the best way to find creative and tailored solutions. Perhaps that’s why more than 80% of tech leaders said their companies have or are evaluating a large-scale relationship with a clean energy provider, across multiple locations for energy and energy services.

This content is sponsored by: