Insights from the Experts at RE+: How 3 Key Sectors are Influencing the Future of Renewable Energy

The 2023 RE+ Conference was a spectacle to behold. Nearly 40,000 industry professionals and subject matter experts gathered in Las Vegas to network, share knowledge, and learn about the current and future state of the energy transition.

Session topics ranged from batteries and microgrids to EV charging and alternative energy sources, but one theme seemed to permeate each subject of debate – we cannot hope to achieve a true energy transition without the help of the consumers and utilities surrounding the industries driving renewable energy adoption.

“The future we want is dependent upon having the conversations we’ve never had before,” said Lon Huber, Senior Vice President of Pricing and Customer Solutions at Duke Energy.

Across multiple sessions, experts identified three industries of great importance: Heavy-duty fleets, Multi-family housing, and Hydrogen.

These three pillar sectors are driving the economy and have the potential to impact the energy transition's success by helping adopt new technologies and methodologies on a broad scale.

“We understand the climate is changing and that there is a crisis. But we don’t have to guess anymore. We know that there is a path to take. Take the technology, incentivize it, and help promote it, just like we did with solar, which used to be expensive but is now easily accessible,” said Angelina Galiteva, Chair of the California ISO Board of Governors.

But when each of these sectors covers an overwhelming amount of territory, the question arises of where one begins to overcome generational challenges and help the energy transition become the new status quo.

Multi-Family Housing

Multifamily housing, such as apartments and condos, currently makes up about 42% of the U.S. housing market. With nearly half of all Americans choosing these urban alternatives over single-family homes, the energy transition cannot afford to overlook this vital market.

But with this opportunity comes unique challenges.

For example, most interactions won’t occur with the actual resident but with the landlord of the property. This means that instead of converting individuals, the landlord must be willing to make a substantial upfront investment to convert all the units to renewable energy, creating an “all or nothing” scenario.

“You need to get landlords on board with installing solar. They are making an investment – there is a cost – and sometimes it’s hard for them when there isn’t an immediate benefit. So, to make this happen, solar developers need to have conversations with decision-makers and show them how they can save money. These projects aren’t going to happen without some help in these cases,” said Christopher Worley, Director of Public Policy at Sunrun.

The utility companies are another key player in bringing renewable energy to multifamily housing.

According to the U.S. Energy Information Administration (EIA), renewable energy accounted for 12% of all energy consumed in the United States in 2021, and that number is projected to double over the next two decades.

To achieve this, those who supply energy must be willing to evaluate their supplied energy mix and have conversations about how to transition more communities to a higher percentage of renewable energy.

“Coming from a utility standpoint, they are typically risk-averse, and change is not something they deal with often,” said Micah Jasuta, Project Manager at Austin Energy. “Change is inevitable, and we have to find a way to work together to keep the systems front and center. Make them feel like what they’re doing is important and has a bigger connection to the community.”

One solution to help these conversations transition into action is to create the understanding that integrating renewable energy into the power grid is not a one-source solution. By its very nature, renewable energy has variability – the wind isn’t always blowing, and the sun isn’t always shining.

By having a mix of energy sources and strategically upgrading the grid with smart technologies, utilities can create a stable supply of electricity from renewable energy that greatly benefits themselves and the ultimate consumer.

Another benefit of utilities integrating renewable sources into their energy mix is the environmental, social, and governance incentives for reducing carbon emissions. This includes government subsidies and tax credits and the security that comes from having a diversified energy portfolio not reliant upon limited resources such as fossil fuels.

There has been progress with these conversations, and according to the EIA, investment in grids rose by 6% in 2021 and is a primary focus of the 2050 net-zero emissions campaign set forth by the United Nations.

Large-Scale Fleet Electrification

According to statistics, as of 2021, there are over 4 million semi-trucks operating in the United States, and these trucks are responsible for moving more than 72% of America’s freight by weight each year. Because of its prevalence and importance to the U.S. economy, this sector has found itself at the center of the energy transition debate.

Fleet owners and operators are largely aware of the benefits of fleet electrification and are making progressive steps to embrace this new way of doing business. For this sector, fleet electrification offers a future-proofing solution to the downfalls of traditional gasoline-powered vehicles.

According to the EIA, the top three operational risks for fleet owners and operators with gas-powered vehicles are:

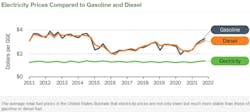

- Fuel costs

- Vehicle breakdowns and mechanical issues

- Maintenance costs

Through fleet electrification, many of these concerns can be mitigated. For example, EVs offer a higher equivalent fuel economy, translating into lower operating costs. EVs also offer a more simplistic design with fewer moving parts and require less maintenance than traditional vehicles.

Overall, according to McKinsey & Company, electric fleets have a significantly lower operational cost, including lower depreciation rates, fuel costs, and maintenance costs, mitigating many owner and operator concerns.

However, although the industry understands the benefits and necessity of transitioning to an all-electric fleet, barriers to entry remain prevalent. This includes the cost of purchasing heavy-duty EVs and the cost of building a charging infrastructure that can support the influx of EVs nationwide.

“This is a generational shift similar to the transition from horse and buggy. It will require building an infrastructure that no one is ready for,” said Adam Browning, Executive Vice President of Policy and Communications at Forum Mobility. “We will need to see more than 20 chargers installed every day in California for the next 15 years just to meet the infrastructure needs. Nothing about our grid is ready for this transition. There are things we can do in the short, medium, and long term to help, but it’s coming, and there are going to be a lot of grid-level and institutional-level changes needed.”

To overcome this, it will take a collaborative effort. Utilities and policymakers who have the power to enact large-scale infrastructure changes must do so in order to ensure fleet owners and private companies are finding success with fleet electrification and barriers to entry are mitigated.

“The momentum is there. The private sector and commercial sector will find a way to make it happen, but there needs to be some catchup from policymakers and utilities,” said Meghan Weinman, Managing Director at Edison Energy. “The depots are ready, the trucks and fleets are ready, but the utilities are not keeping up. It’s up to utilities and policymakers to be in lockstep with entities progressing the market.”

Hydrogen

For decades, industries have been aware of hydrogen’s potential to become a partner in the energy transition journey. While hydrogen is a formidable energy carrier, it has traditionally been produced using limited resources, such as coal and natural gas, which emit carbon dioxide.

Green hydrogen, or hydrogen produced from renewable or nuclear energy, presents an opportunity to overcome this issue while supplying a viable alternative to help transition difficult-to-decarbonize sectors.

“Hydrogen is a factor that allows us to decarbonize electricity and then use that electricity to decarbonize other sectors that would not be able to easily decarbonize otherwise, such as aerospace and shipping,” said Angelina Galiteva. “It was the same with solar. It took a while to get it to the main consumer. We need to focus on scaling and making sure we have a clear path to getting that goal.”

According to the International Energy Agency, if the industry used 100% renewable energy for hydrogen production instead of fossil fuels, it would reduce the level of emitted CO2 by 830 million tonnes annually. However, less than 1% of the global hydrogen supply currently comes from renewable energy sources.

To bolster this statistic, policymakers are stepping up to the plate to create opportunities that provide companies with incentives to produce green hydrogen. For example, the Department of Energy recently awarded $34 million to 19 projects advancing the availability of clean hydrogen. New York also launched its own initiative, providing $14 million for clean hydrogen research, development, and demonstration.

Ultimately, policies and incentives will be crucial to counteracting the challenges associated with green hydrogen.

“There are so many different opportunities with hydrogen to help us achieve our goals, but challenges include cost, storage, transportation, and price transparency,” said Brian Weeks, Senior Director of Hydrogen Business Development at GTI Energy. “You need to mitigate the risk. Who is going to buy a contract for hydrogen when you can’t reduce the risk? For that to happen, we need some regulatory help and infrastructure investment.”

The Journey Ahead

The energy transition is a long and complex road that involves multiple industries and sectors working together to achieve a common goal. It involves having difficult conversations and finding common ground to develop solutions that will carry businesses, consumers, and the world at large into the next evolution of the energy transition.

Consumers and energy providers must come together to create viable solutions that make renewable energy accessible, affordable, and practical.

“We have a long journey ahead of us, and there is a lot of work to be done,” said Meghan Weinman. “Be flexible – things are going to look a lot different five years from now.”