Schneider Electric "Flex-ing" Standardized Microgrid offering to C&I Market

(Editor's Note: This story originally ran in May 2023 as a report from the Microgrid Knowledge Conference. We at EnergyTech are running it again to coincide with the "The Future of Microgrids" webinar happening Thursday, Nov. 21 at EnergyTech.com).

Nothing is typical about microgrids, but a relatively average on-site distributed energy platform for a commercial and industrial customer could cost more than $4 million.

Perhaps that’s a drop in the accounting bucket for a large-scale manufacturer seeking a bottom line to achieve ESG promises and decarbonization with solar, battery and backup generation which can island when the grid is down. Those price tags are different matters for startups and smaller business use cases.

Standardizing and modularizing that microgrid template can provide solutions to challenges both technical and fiscal.

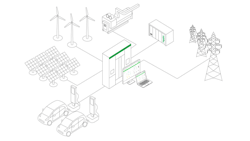

At this week’s Microgrid Knowledge 2023 Conference in Anaheim, Schneider Electric unveiled its new EcoStruxure Microgrid Flex offering. The Flex would produce a consistent set of microgrid controls, inverter and generation equipment to facilitate an easier investment choice for mid-level commercial and mission-critical customers who must work within those calculations and make decisions quicker.

“Flex helps shorten the time to realize deployment,” BaLa Vinayagam, senior vice president for microgrids at Schneider Electric, said during the press event at Microgrid 2023 inside the Anaheim Marriott.

“It can reduce the interconnection delay from 123 weeks to 40 weeks,” Vinayagam added. “I strongly believe the combination of centralized grid and decentralized grid is needed to achieve what we’re talking about" on the path to Net Zero emissions goals.

Collaboration also is crucial, and Schneider Electric is not going it alone with the EcoStruxure Microgrid Flex rollout. Developer and distributed energy resource platform firm Scale Microgrids is an inaugural partner on the Flex offering, and Schneider Electric is welcoming others in the journey to standardize a part of the DER sector.

“We are very excited to be one of the first partners working with Schneider Electric to deliver EcoStruxure Microgrid Flex to the market,” Ryan Goodman, CEO of Scale Microgrids, said in a statement. “We believe that utilizing Microgrid Flex will enable us to deliver groundbreaking distributed energy systems to our customers with unprecedented speed and efficiency.”

The new offering spins off of the EcoStruxure Microgrid and Adviser units at Schneider Electric. The company for years has overseen and commissioned numerous and varied microgrid projects nationwide.

The core idea behind Flex is coordinating a consistent portfolio of components to streamline the microgrid pathway from sale, design, construction and commissioning. A recent Berkeley National Lab report indicated that many interconnection requests from distributed energy projects take four years or longer to realize, with the result that nearly two-thirds of those quashed.

The EcoStruxure Microgrid Flex partnership initially would focus on projects within a 300-kW to 1.5-MW range. The desired customer base would include commercial and industrial office buildings, distribution warehouses, indoor agriculture, public services and safety and health care facilities, or similar type footprints.

The limitations some of those customers have can actually propel the potential for dramatic expansion of microgrid adoption, the participants say. Making sure the price is right, in other words.

“If we don’t do this in bulk, we can’t price it the same way,” Don Wingate, vice president, sales, for microgrid and the New Energy Landscape unit at Schneider Electric, said during the announcement presser at Microgrid 2023. “There’s got to be constraints.”

Schneider Electric, which is a longtime energy-as-service microgrid developer, will still sell and deploy DER projects engineered to order. The Flex pathway offers a standardized unity for customers who not only have those type of resiliency and sustainability goals but also some financial limitations.

Samantha Childress, who will guide the partnership strategy for the EcoStruxure Microgrid Flex program, pointed out that the guardrails do not limit Schneider’s ability to deliver customized DER projects, but rather open access to a fast-growing line of customers seeking decarbonization at the smaller to mid-level commercial and industrial sectors.

“That’s our guard rail,” Childress said.

Various market forecasts predict that the microgrid sector value could grow multiple times to $85 billion or more by 2030. Various distributed energy systems likely will be needed to deal with the grid adaptability challenges to ultra-fast electric charging stations, business sustainability and energy reliability desires and redundancy to protect against climate threats to the main grid.

Next year's Microgrid Knowledge Conference will be April 2024 in Baltimore.